Salaries shape our careers, lifestyle choices, and future plans — yet few people really understand how they're calculated. Whether you're paid hourly, monthly, or annually, our salary calculator guide breaks down everything you need to know about pay structures, estimators, and how to make the most of your paycheck.

What Is a Salary, Really?

At its core, a salary is a fixed amount of money you’re paid by an employer, usually expressed as an annual figure. Unlike hourly wages — which are calculated based on the time you work — a salary assumes you’ll be paid the same amount each pay period, regardless of how many hours you actually put in.

💡Did you know? The word "salary" comes from the Latin word salarium, which was money paid to Roman soldiers to buy salt! That’s right — people used to get paid in salt, which was a valuable currency at the time.

That said, it’s more than just a number on a job offer. A salary reflects your role, responsibilities, experience, and even the economic conditions of your industry. Some people are paid monthly, others biweekly, but most offers refer to the annual salary — which is why tools like an annual salary calculator are so useful for making sense of it all.

Let’s take an example. Imagine a hospital hires a nurse on an hourly wage, but the hospital administrator is offered a monthly salary. Even though they both work full-time, their compensation structure — and how they think about their income — is completely different. One sees money based on hours worked; the other, as a stable monthly figure.

Check out our Everyday Life and Finance section to get more practical tips and smart tools for daily living and money management.

Annual vs. Monthly vs. Hourly Salary

Let’s be honest — salary terms can sound a little cold. “Annual,” “monthly,” “hourly”… they all mean money, but in very different ways. And the way you're paid actually says a lot about your job, your stability, and how you can plan your life.

-

If you're offered an annual salary, you're getting the big picture: the full amount you'll earn in a year. It sounds impressive, but it’s not always easy to visualize. That’s where an annual salary calculator comes in handy — breaking it down into monthly or even hourly pay so it actually makes sense.

-

With a monthly salary, things feel more predictable. You know what’s coming in every month, and it’s easier to budget. This is common in traditional jobs — think office roles, medical professionals, or public sector employees. A monthly salary calculator can help when you're comparing job offers.

-

If you're working hourly, your income depends on how much you work. Some weeks are great, others might dip — especially if you’re in retail, hospitality, or freelance. A salary calculator for hourly workers helps estimate your take-home pay without the guesswork.

Each structure has pros and cons. Knowing yours helps you make smarter financial decisions

Employee Benefits and Miscellaneous Considerations

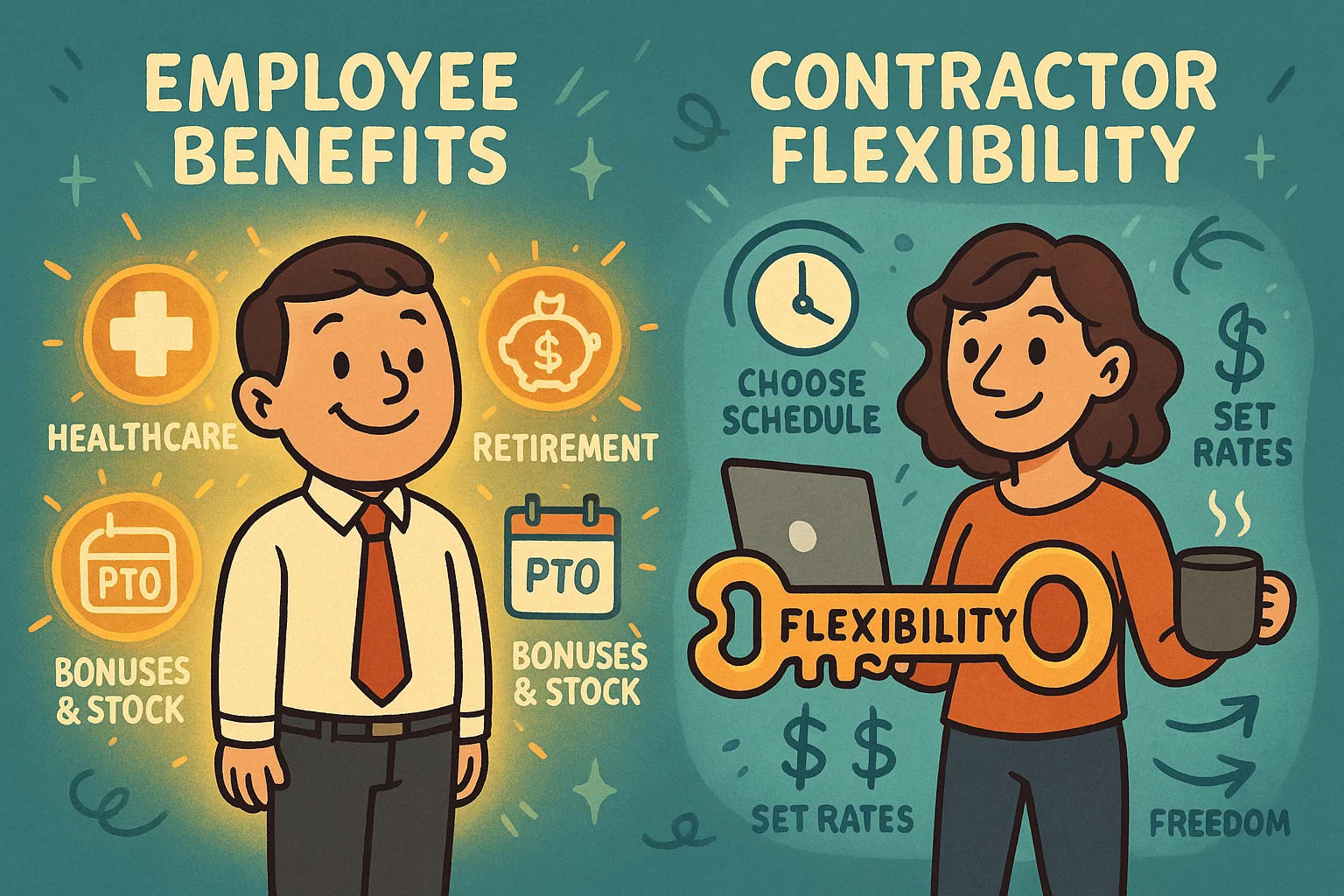

When evaluating your salary, it’s essential to consider the full compensation package. Many salaried employees are offered additional benefits that significantly enhance their overall earnings:

-

Healthcare Coverage: Medical, dental, and vision insurance are often included for salaried employees.

-

Retirement Plans: Employer-sponsored retirement plans such as 401(k) or pensions help employees save for the future.

-

Paid Time Off (PTO): Vacation days, personal days, and sick leave are usually part of salaried compensation packages.

-

Bonuses and Stock Options: These are common in high-level positions and can contribute to overall compensation.

However, if you're a self-employed contractor, you’ll likely set your rates independently. While you don’t receive the same benefits as salaried employees, you may have the flexibility to adjust your pay rates and work schedule as you see fit. As a contractor, your pay may be higher to offset the lack of employee benefits and job security.

How to Calculate Your Salary

Ever wonder how your salary offer is actually decided? It’s not just a number someone pulls out of thin air — there's a bit of math (and a lot of strategy) behind it.

Most companies start with a yearly salary estimator — a formula that calculates total compensation based on job role, expected hours, and market standards. At its simplest, the math looks something like this:

Hourly rate × hours per week × weeks per year = annual salary

For example, if you earn $25/hour and work 40 hours a week for 52 weeks, your estimated yearly salary would be $52,000. That’s the base — but it’s only the beginning.

Your final salary also depends on:

-

Company size and budget

-

Industry standards

-

Your education and experience

-

Benefits (like insurance, paid leave, bonuses)

-

Tax structure and local labor laws

Many HR teams use internal tools — similar to our Pay Check Calculator — to model what your paycheck will look like after deductions. This helps them create offers that feel competitive but still fit within their compensation budget.

Salary vs. Income

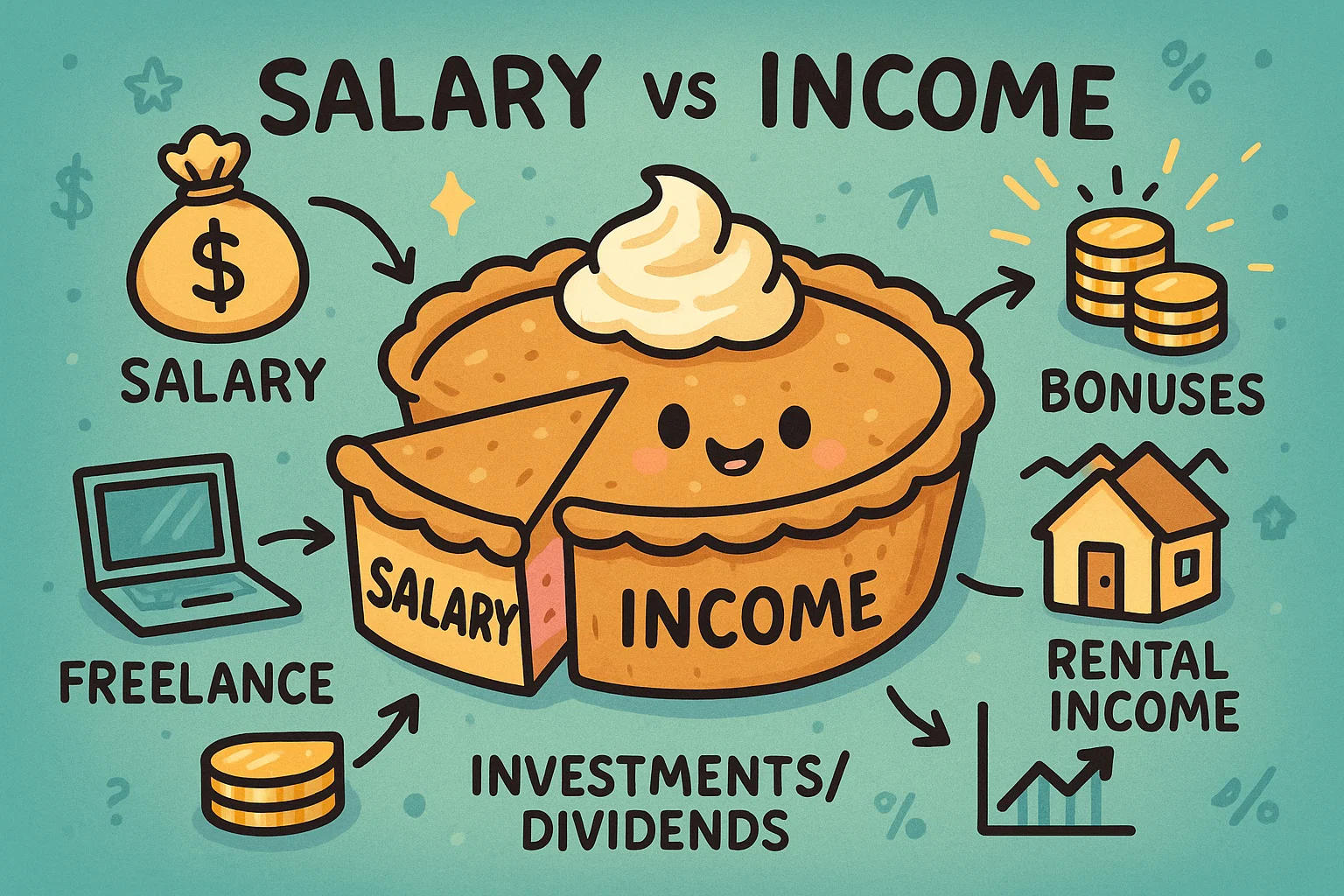

It’s easy to think of salary and income as the same thing — but they’re not. And mixing them up can lead to major confusion, especially when you're budgeting, doing taxes, or planning a career move.

Salary refers to the fixed amount you’re paid by an employer. It’s usually agreed upon in advance, stated as an annual, monthly, or hourly figure, and doesn’t change unless you get a raise or renegotiate your contract.

Income, on the other hand, is the total amount of money you actually earn — and it can include more than just your salary. That means:

-

Bonuses or overtime pay

-

Freelance gigs or side hustles

-

Rental income

-

Dividends or investments

Let’s look at a simple case:

Maria works full-time as a marketing manager with an annual salary of $72,000. On weekends, she also does freelance graphic design and earns an extra $1,000–$1,500 per month. Her salary is $72,000 — but her income is closer to $85,000 a year.

Now compare that with Alex, a full-time freelancer. He doesn’t have a fixed salary, but his income fluctuates monthly depending on how many clients he books.

Bottom line: salary is a piece of the pie, but income is the whole dessert. When you’re thinking about financial goals, or even just figuring out how much you actually make, this distinction makes all the difference.

Salary Calculation in the U.S.: Exempt vs. Non-Exempt Employees

In the U.S., exempt and non-exempt employees are governed by the Fair Labor Standards Act (FLSA), which determines eligibility for overtime pay.

-

Exempt Employees: These employees are not entitled to overtime pay and generally hold higher-level positions requiring specialized skills or education.

-

Non-Exempt Employees: These employees are entitled to overtime pay for any hours worked beyond the standard 40 hours per week.

It's crucial to understand whether you are exempt or non-exempt as it can impact your pay structure, including potential overtime earnings.

Federal Holidays and Paid Time Off (PTO)

In addition to salary, understanding how holidays and vacation days affect compensation is important. Most employers in the U.S. recognize the following federal holidays:

-

New Year's Day

-

Martin Luther King Jr. Day

-

Memorial Day

-

Independence Day

-

Labor Day

These holidays may result in a day off with pay for salaried employees. However, for hourly wage earners, the rules can vary. Some employers may offer additional pay (holiday pay) for hours worked on holidays.

Many companies also offer Paid Time Off (PTO) policies, which combine vacation, sick leave, and personal days into one pool. This allows employees to take time off when needed without losing income.